KPay Raises $55M to Expand SME Financial Management Platform Across Asia

KPay, a fintech startup offering a unified financial management platform for small and medium-sized businesses (SMBs), has raised $55 million in a Series A funding round led by London-based Apis Partners. The fresh capital will support product development, market expansion, and strategic acquisitions as KPay accelerates its mission to modernize financial solutions for businesses in Asia.

Addressing SMB Financial Challenges

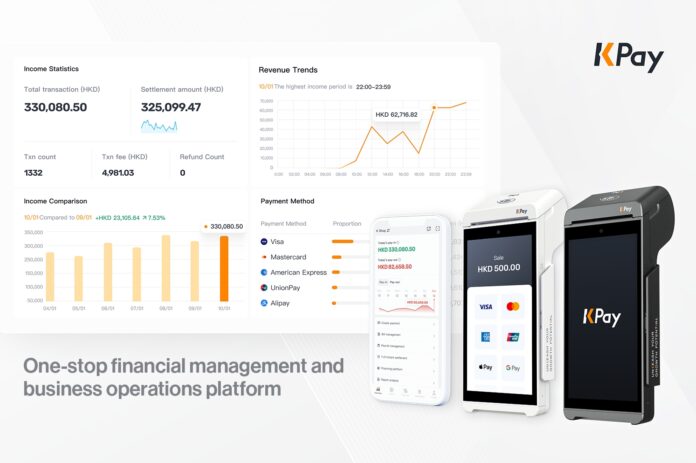

Founded three years ago, KPay emerged from the realization that traditional financial systems fall short of meeting SMBs’ modern needs for agility, integration, and actionable insights. The platform simplifies financial management by integrating payment processing, payroll, bill settlements, and remittances into a single system. This unified approach enhances efficiency, reduces costs, and provides businesses with critical data for decision-making.

KPay partners with over 150 SaaS providers, banks, and financial services firms, offering its services to 45,000 merchants across Hong Kong, Singapore, and Japan. The company plans to expand its network to serve more businesses throughout Asia, aiming to bridge the digital divide between small businesses and larger enterprises.

Strategic Growth and AI Integration

The $55 million funding will drive KPay’s growth strategies, including enhancing its product offerings, improving customer experiences, and expanding into new Asian markets. Additionally, the startup is exploring AI-driven innovations to improve merchant operations, boost efficiency, and increase revenue potential.

KPay’s CFO, Christopher Yu, noted that the company has achieved a compound annual revenue growth rate of 166% since its inception. With a vision to onboard 1 million merchants in the next five years, KPay is positioning itself as a leader in fostering an inclusive digital economy.

Scaling Operations Across Asia

With a team of 440 employees across its offices in Hong Kong and Singapore, KPay continues to scale its operations and support businesses across diverse industries. The platform’s commitment to offering secure, flexible, and integrated financial solutions positions it as a valuable partner for SMBs navigating the challenges of modern commerce.

For the latest updates on business software and digital transformation, subscribe to Staq Insider

Need expert help to select and purchase the right software stack, check Staq42